The deadline is approaching! The obligation to receive and issue electronic invoices (e-invoicing) and to transmit transaction data (e-reporting) will gradually be extended to all French companies subject to VAT. At Azopio, as the publisher of an EDM document management and pre-accounting solution, we’re here to guide you.

Electronic invoicing isn’t just about digitisation: it’s a process overhaul that starts well before the invoice is sent to the customer, and has a direct impact on the way your accounts are prepared.

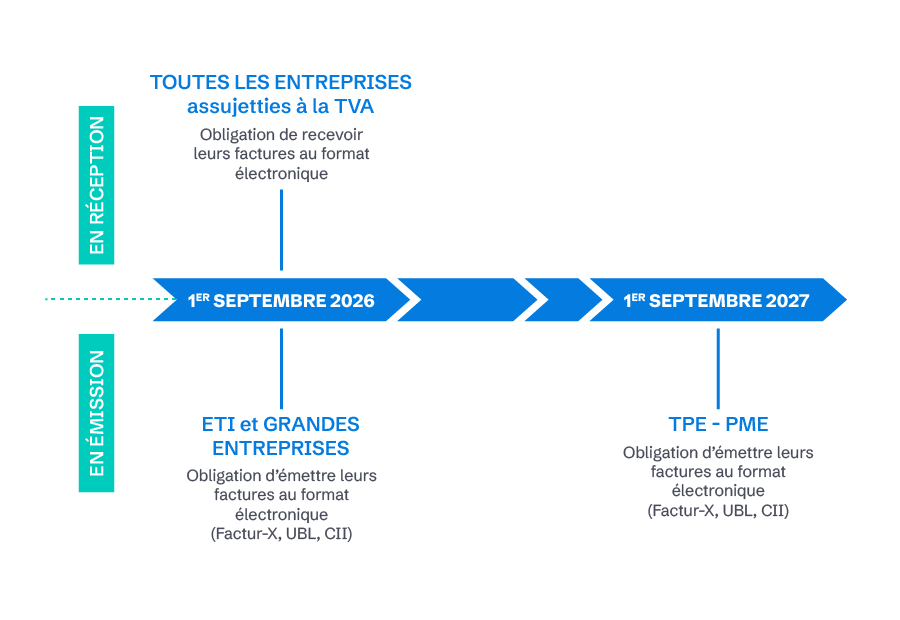

A reminder of the timetable and objectives

The reform of electronic invoicing has the dual aim of combating VAT fraud and simplifying returns.

- 1st September 2026:

- Obligation to ISSUE electronic invoices for Large Enterprises (LE) and Intermediate-Sized Enterprises (ISE).

- Obligation for all companies (of all sizes)to RECEIVE electronic invoices.

- 1st September 2027:

- Obligation to ISSUE electronic invoices for Small and Medium-sized Enterprises (SMEs) and Very Small Enterprises (VSEs).

The objective is clear: invoice data (e-invoicing) and transaction data (e-reporting) must circulate in a structured and secure way between the issuing company, the receiving company and the tax authorities.

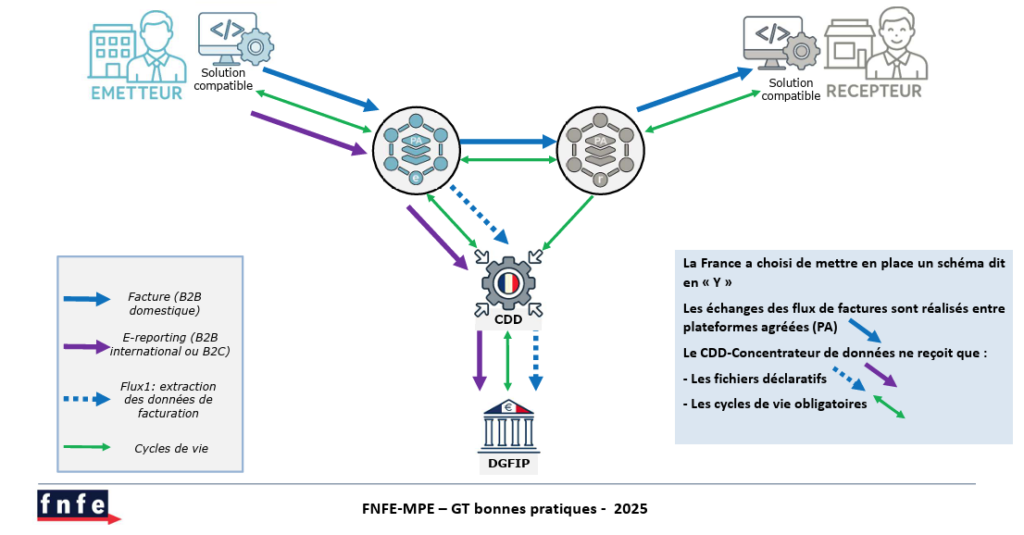

The central role of PA Authorised Platforms (formerly PDP Partner Dematerialisation Platforms)

To guarantee this circulation, the State has set up a new transmission circuit, the famous “Y”:

- Issuers send their electronic invoices to their Approved Platform (AP), a dematerialisation platform (ex-PDP), such as Azopio.

- The issuer’s PA sends the invoice to the CdD Data Concentrator (formerly the Public Billing Portal (PPF)).

- The sender AP transfers the invoice to the recipient AP.

- The recipient’s IP makes the invoice available to the recipient company.

- The Data Concentrator (CdD, ex-PPF) transmits invoicing data (lifecycle status, amounts, VAT) to the tax authorities, the DGFiP.

Azopio is a platform that simplifies this process and guarantees the compliance of your data flows.

3 key steps to prepare your accounts

Preparing your accounts for e-invoicing and e-reporting is all about optimising data and processes.

1. Ensure the reliability of your master data (Third Parties and Products)

The electronic invoice is a structured data file (UBL, CII or Factur-X format) that must be accurate.

- Third-party identifiers: Make sure you have the SIRET or intra-Community VAT numbers of all your customers and suppliers up to date. This is essential for proper routing by the platforms.

- Accounting codes: There are no changes to the General Chart of Accounts (PCG), but the automation required by e-invoicing means that your account codes (customers, suppliers, products/services) need to be applied consistently in your system.

2. Digitalising and automating the supplier invoice life cycle

The reform also concerns the invoices you receive. The main advantage is theautomation of pre-accounting.

- Centralised reception: By choosing Azopio, all your invoices received via AP will be centralised and directly available in a usable format.

- Extraction and pre-assignment: Our dematerialisation solution automatically restores data from structured files received or extracts data from them in the case of receipts or invoices from foreign suppliers (amount, date, VAT, etc.) and pre-assigns them to the corresponding accounting accounts, based on the data you have made reliable.

💡 The benefits: less manual data entry, a better audit trail, and high-quality transmission of entries to your accounting software or that of your chartered accountant.

3. Implement e-reporting for B2C and international transactions

E-reporting is the obligation to transmit to the tax authorities data on transactions that do not involve electronic invoicing ( B2C sales,international sales).

- Identification of flows: clearly identify in your system the transactions that fall within the scope of e-reporting (e.g. sale to a private individual, provision of a service in Germany).

- Simplified transmission: Your Authorised Platform such as Azopio can act as an intermediary to collect and transmit transaction data at the intervals required by the tax authorities.

Azopio, your partner for a smooth transition

Preparing your accounts for electronic invoicing means first and foremost adopting the right tools.

By choosing Azopio, you are opting for :

- A PA at your service: We will be the entry and exit point for your electronic invoices, guaranteeing compliance with formats and secure transmissions.

- Optimised pre-accounting: Our solution is natively designed for dematerialisation and automation, transforming a simple invoice into a ready-to-use accounting entry.

- Simplified collaboration between accountants: Documents and entries are transmitted securely to the firms in real time, reducing the need for round-trips and the risk of errors.

Don’t be a victim of reform, use it as a lever for efficiency!

Ready to digitise and automate your invoicing, pre-accounting and EDM processes so you’re ready on time? Find out more about the Azopio solution and request a free demo.